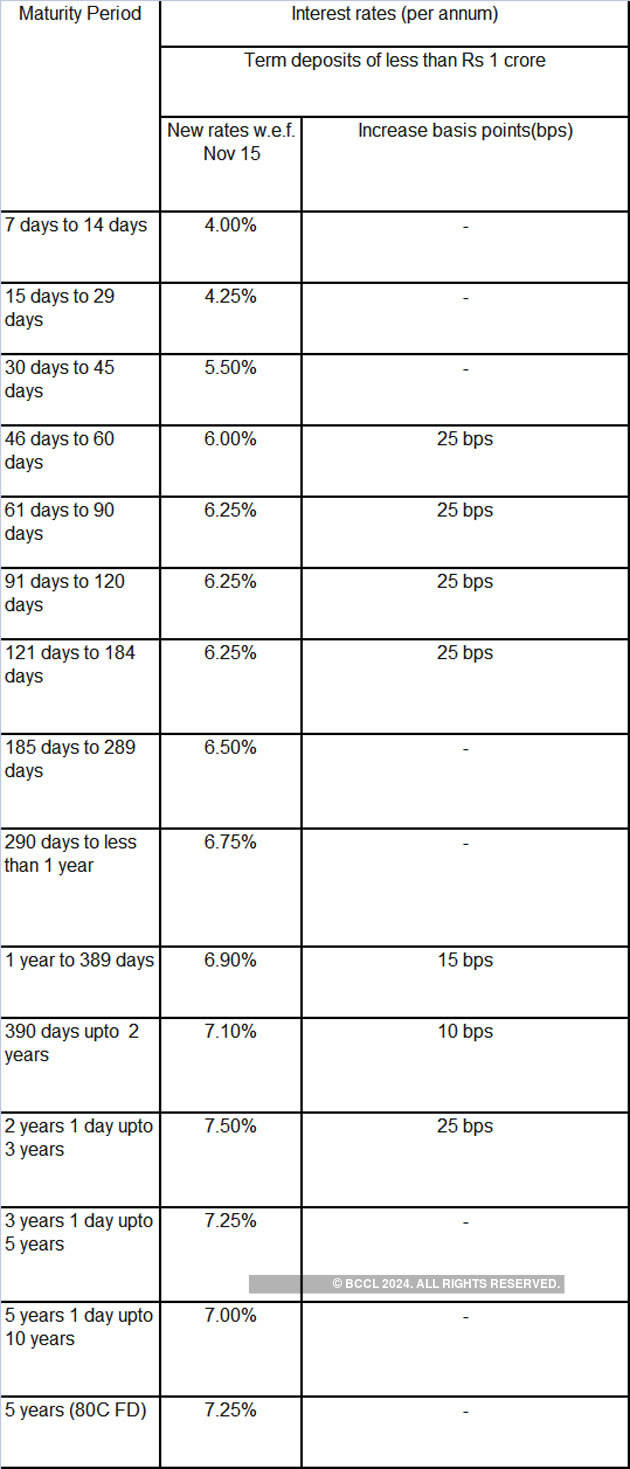

Bank Term Deposit Rates

- Term Deposit interest is calculated on the daily closing balance of the account and can be credited (compounded) to the term deposit account annually or on maturity. Term deposits lodged for more than 12 months must have interest paid at least every 12 month period as well as at maturity and the interest can be compounded to the principal.

- Rates are available for Retail and Business Banking customers and apply up to the first $5,000,000 held by the customer in all term deposits with ANZ. For rates applicable to amounts in excess of.

Term Deposit Interest Rates

Invest your savings in a Term Deposit with confidence of a guaranteed return. Term Deposits allow you to plan for your future and invest with confidence, knowing that you will receive a higher rate of return than many savings accounts. Gateway's deposits are guaranteed under the Government's Financial Claims Scheme.

Understanding the Step Rate APY. Minimum opening deposit $2,500 You get an automatic interest rate increase every six months during the term of the CD. The APY (Annual Percentage Yield) reflects the total interest that will be paid from all step rates during the term of the CD and assumes interest remains on deposit until maturity. . For terms & conditions and any other details, please contact your nearest Axis Bank Branch. Rates are subject to change without any prior notice.The Bank at its discretion, may disallow premature withdrawal of large deposits for amount Rs.5 crores and above, held by entities other than Individuals and Hindu Undivided Family (HUF).

Standard term deposits

Bank Term Deposit Rates Australia

The following interest rates apply to standard term deposits where interest is paid at maturity or periodically to a savings account. For compounding term deposit interest rates, please see our Interest Rate Schedule.

Term Deposit Rates - Minimum $1,000

Bank Term Deposit Rates Nz

| Interest rate | |

| 3 months | 0.60% p.a. |

| 4 months | 0.60% p.a. |

| 5 months | 0.60% p.a. |

| 6 months | 0.65% p.a. |

| 7 months | 0.60% p.a. |

| 9 months | 0.60% p.a. |

| 11 months | 0.60% p.a. |

| 12 months | 0.75% p.a. |

| 18 months | 0.65% p.a. |

| 24 months | 0.65% p.a. |

| 36 months | 0.65% p.a. |

| 48 months | 0.65% p.a. |

| 60 months | 0.65% p.a. |