Deposit Account

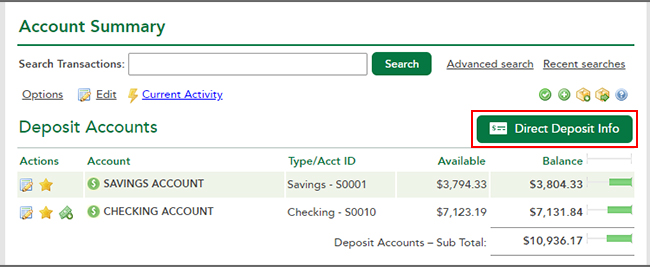

Set Up or Change Your Direct Deposit of Benefit Payment

- Deposit Account Control Agreement (DACA) — A tri-party agreement among a customer (debtor), a secured party (lender) and a bank that allows the lender to perfect a security interest in the customer’s funds by taking control of the deposit account (UCC § 9-104).

- Get answers to your questions about Bank of America deposit accounts. Whether you are looking for a routing number, setting up a direct deposit, or looking for a SWIFT code for international deposits - get your questions answered.

May 06, 2017 What is the Deposits Account? Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments. For example, a company may require a large deposit from a customer before it begins work on a highly. The amount by which a Deposit Account will be replenished will be specified by the holder. Automatic replenishment will be triggered when the Deposit Account goes below the previously established minimum level of funding, and Deposit Account holders will be automatically notified that their accounts will be replenished. Participation Options: maintain a combined deposit and loan balance of $500, a checking account with direct deposit and online statements, a current or paid off loan, are under the age of 25, have been a member for 10 years or more, or have a portfolio with Rogue Investment Services.

Do you want to set up or change the direct deposit of your benefit payment? We are constantly expanding and improving our online services, including the ability to set up or change your direct deposit information. If you already receive Social Security or Supplemental Security Income (SSI) benefits and you have a bank account, simply log in to or create your personal and secure mySocial Security account.

What is Direct Deposit?

Direct deposit is a simple, safe, and secure way to get benefits. If you need us to send your payment to a bank or credit union account, have all of the following information ready when you apply.

- Social Security number

- Bank routing transit number

- Account type (checking or savings)

- Account number

How to Set Up or Change Direct Deposit of Benefit Payment Online

- Log in to your account.

- Sign in and Select the blue Benefits & Payment Details link on the right side of the screen.

- Scroll down and select the Update Direct Deposit button, and choose if you are the owner or co-owner of the bank account.

- Enter your bank account information and select Next.

- Review and verify your banking information and select Submit then select Done.

- You can also decide when your change will take effect, by simply using the My Profile tab within mySocial Security.

Don't have a mySocial Security Account?

Creating a free mySocial Security account takes less than 10 minutes, lets you set up or change your direct deposit and gives you access to many other online services.

Additional information related to this service

As of March 1, 2013, you are required to receive your payments electronically. If you applied for benefits before that date and did not sign up for electronic payments at that time, we strongly urge you to do so now. For more information regarding switching to an electronic payment if you don’t have a bank account, visit Treasury’s Go Direct website or call the helpline at 1-800-333-1795.

Still have questions?

If you have questions or need help understanding how to set up or change direct deposit online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.

In years past, getting paid meant receiving a physical check from your employer that you would then bring to a bank in order to cash or deposit into your checking or savings account. Often, this meant spending your lunch break on pay day waiting in line at the bank, or else waiting until the weekend to access your money.

Today, there are more convenient options for getting paid. According to the National Automated Clearing House Association (NACHA), more than 80 percent of workers in the United States now get their pay by direct deposit.

We define exactly what direct deposit is, how it works, and how direct deposit accounts differ from other kinds of bank accounts.

What is direct deposit?

Direct deposit is a form of payment wherein funds are electronically transferred into your savings or checking account, in lieu of a paper check. Though direct deposit is most commonly leveraged by employers paying their employees, it can also be leveraged for other purposes: for example, when receiving a tax refund, Social Security or disability benefits, or other types of payments. Direct deposit ultimately relies on the infrastructure of the Automated Clearing House (ACH) network, which gives banks an easy means of transferring money electronically.

A direct deposit account is simply a checking or savings account which offers the ability to send and receive funds electronically. Most checking and savings accounts available through commercial banks now come with direct deposit capabilities by default.

How does direct deposit work?

As mentioned above, direct deposit in the United States works by utilizing the Automated Clearing House (ACH) network. This is an electronic system that allows banks and other institutions to electronically transfer funds. It is run, governed, and administered by the National Automated Clearing House Association (known as Nacha), a non-profit funded by the financial institutions that use its network. In 2018, the ACH facilitated and processed nearly 23 billion financial transactions, worth approximately $51.2 trillion.

The ACH uses two numbers—your bank’s routing number and your personal bank account number—to know precisely where money should be deposited or withdrawn from.

How to sign up for direct deposit

Whether it’s to receive your weekly pay, a tax refund, Social Security benefits or any other payment, signing up for direct deposit through ACH is typically pretty straightforward. It requires that you fill out a single form providing the following information:

The account number of the bank account you want funds deposited into (most commonly a checking or savings account)

Your bank’s routing number

Your bank’s physical address

A voided check or deposit slip (used to verify your account and routing numbers)

You may sometimes also be asked to supply your Social Security number, mailing address, or other information, but this will vary from employer to employer.

You can find your routing number and account number on your check, or by logging into your bank account online.

As an employee, you’ll likely be given the opportunity to opt into direct deposit during the onboarding process when you are hired. If at any point you would like to change your direct deposit so that it is deposited into another bank, or stop it altogether in lieu of paper checks, you can do so by requesting that change through your employer, usually by speaking with the accounting or human resources department.

Depending on the options offered by your employer, you may also be able to access split deposits, which allow you to divide your direct deposit between multiple accounts—such as a checking and a savings account—instead of a single account. This can help some individuals reach their savings goals by automating savings.

After you have submitted your direct deposit request form, it can be wise to ask your employer how long it takes for direct deposit to begin. It’s usually between one and two payment cycles to set up direct deposit, during which time you may need to rely upon paper checks.

Once you have successfully set up direct deposit, you will no longer receive paper checks. Instead, funds will be deposited directly into the designated account(s). When these funds are deposited will depend on your employer and when transactions are posted, but it typically coincides with a regularly scheduled payday.

The benefits of direct deposit

People choose to sign up for direct deposit for a number of reasons. The most common of these include

Convenience

Direct deposit removes the need to make a trip to the bank and deposit a physical check in person. In addition to everyday convenience, this makes getting paid easier during times when you may be traveling or are otherwise too busy to visit a bank.

Faster access to funds

Because direct deposit means that funds are deposited into your bank account immediately, it is possible to access them as soon as they are in your account. This can be particularly beneficial for one-time payments, such as receiving a tax refund check or other form of payment. A physical check may take anywhere from 7 to 10 business days to reach you by mail.

Increased security

Because a physical check is never exchanged, there are fewer opportunities for the check to be lost, stolen, or altered.

Paperless

Electronic deposits mean fewer paper checks being printed and ultimately ending up shredded in landfills, which is better for the environment.

Low cost

Sending a direct deposit payment via ACH is inexpensive for employers, and typically free for employees. That means you’re not paying for the added convenience that direct deposit offers.

Potential for other savings

Many banks charge their checking customers a monthly fee to have a checking account—often to the tune of $6 to $15 per month. But often they’ll waive these fees for individuals who enable direct deposit into their checking account, which can lead to significant savings. Saving $15 per month would add up to $180 per year.

Automated savings

Deposit Accounts Blog

For individuals leveraging split deposits, direct deposit can make it easier than ever to automate savings and reach your financial goals by divvying funds between multiple accounts.

In most cases, signing up for direct deposit is an incredibly easy and straightforward process. It’s convenient, it often allows you to access your money faster compared to paper checks, and it can even save you money. If you’re interested in signing up for direct deposit, speak to a member of your human resources or accounting department for details specific to your employer.

Investing involves risk including loss of principal. This article contains the current opinions of the author, but not necessarily those of Acorns. Such opinions are subject to change without notice. This article has been distributed for educational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.